In the fast-paced world of fintech, scalability and reliability are not just desirable—they’re essential. As customer bases expand and transaction volumes skyrocket, the need for robust application infrastructure becomes paramount. This blog post delves into how we partnered with a fintech startup to transform their infrastructure, enabling it to handle 10x growth seamlessly.

The Challenge: Scaling for Exponential Growth

Identifying Pain Points

The fintech startup approached us with several challenges:

- Performance Bottlenecks: The application slowed during peak transaction times.

- Downtime Issues: Unscheduled outages affected customer trust.

- Limited Scalability: The existing monolithic architecture couldn’t support rapid growth.

- Cost Inefficiencies: The infrastructure was over-provisioned, leading to unnecessary expenses.

Goal Setting

Our primary objectives included:

- Achieving 99.99% uptime.

- Reducing latency by 50%.

- Enabling the system to scale automatically to support a 10x increase in user base.

The Solution: Transforming Infrastructure for Scalability

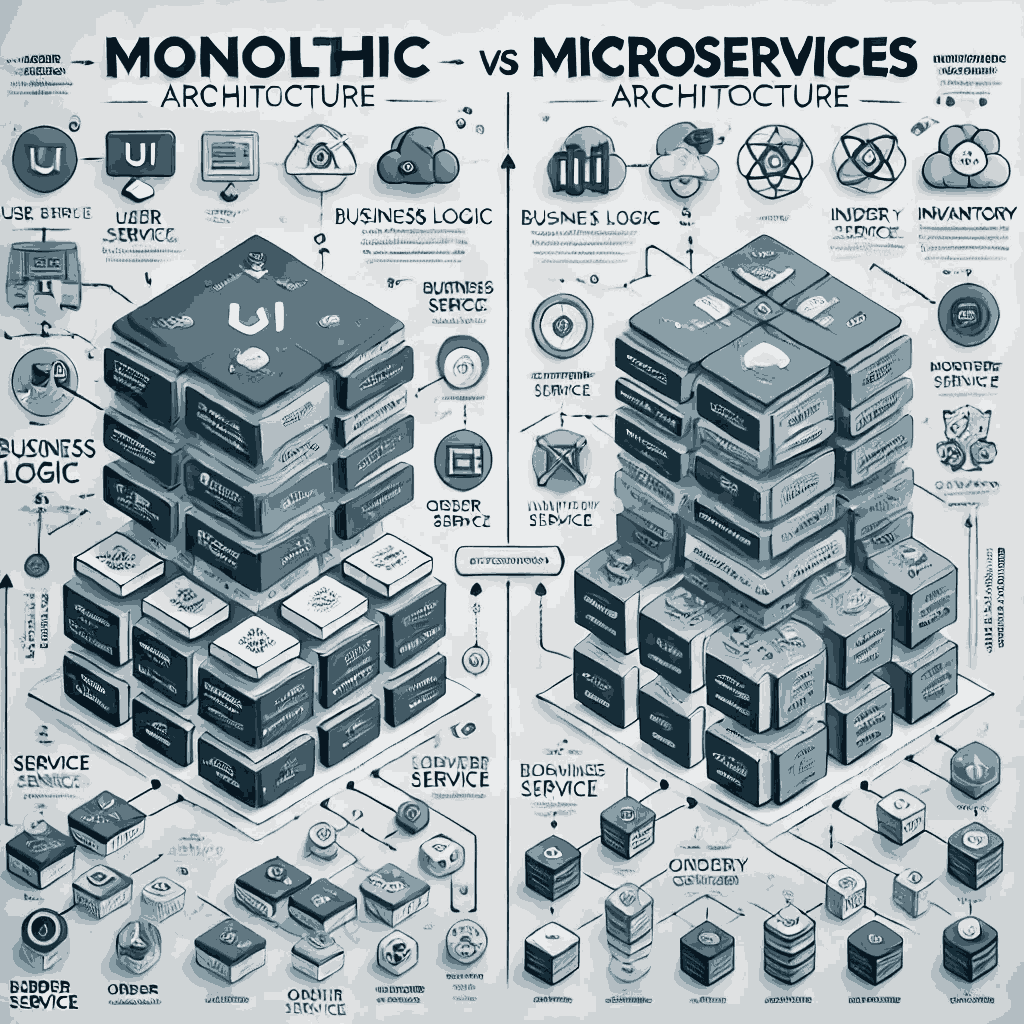

1. Adopting a Microservices Architecture

We migrated the application from a monolithic structure to a microservices-based architecture. Each service was designed to perform a specific function, allowing independent scaling and development.

2. Implementing Cloud-Native Solutions

Moving to a cloud-native platform provided the flexibility and scalability required. Key steps included:

- Using Kubernetes for container orchestration.

- Adopting AWS Lambda for serverless computing.

- Leveraging Auto-Scaling Groups for dynamic resource allocation.

3. Optimizing Database Performance

The database layer was optimized to handle increased loads:

- Migrated to a distributed database system (e.g., Amazon Aurora).

- Implemented caching mechanisms using Redis.

- Introduced read replicas to balance the load.

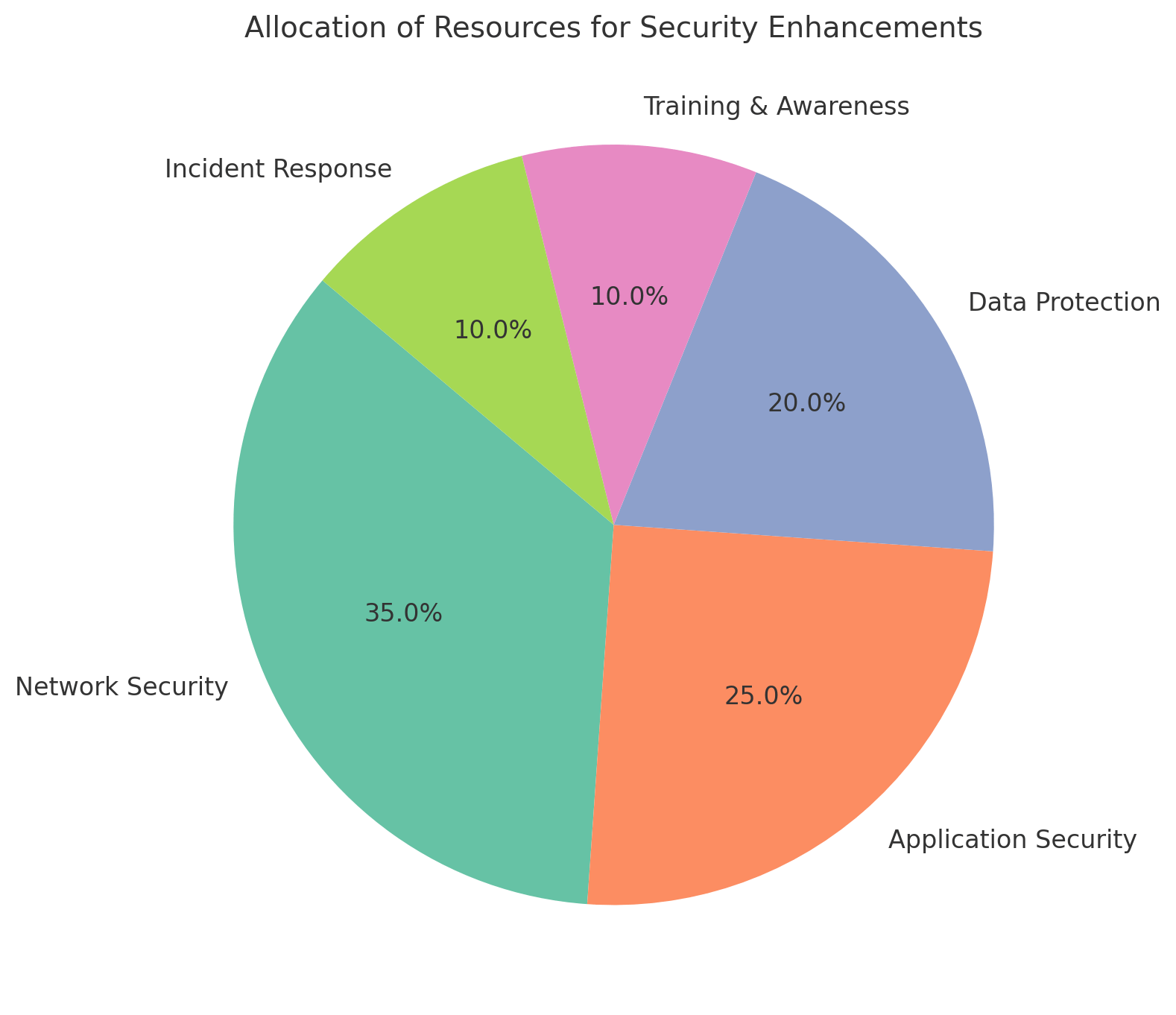

4. Enhancing Security Measures

As scaling introduced new vulnerabilities, we:

- Deployed AI-driven threat detection tools.

- Implemented zero-trust network policies.

- Regularly performed penetration testing.

5. Automating CI/CD Pipelines

Continuous Integration and Continuous Deployment pipelines ensured faster delivery cycles and reduced manual intervention.

Results: Measuring Success

1. Improved Performance

- Latency reduced by 60%.

- Transaction times dropped from 1.5 seconds to 0.5 seconds.

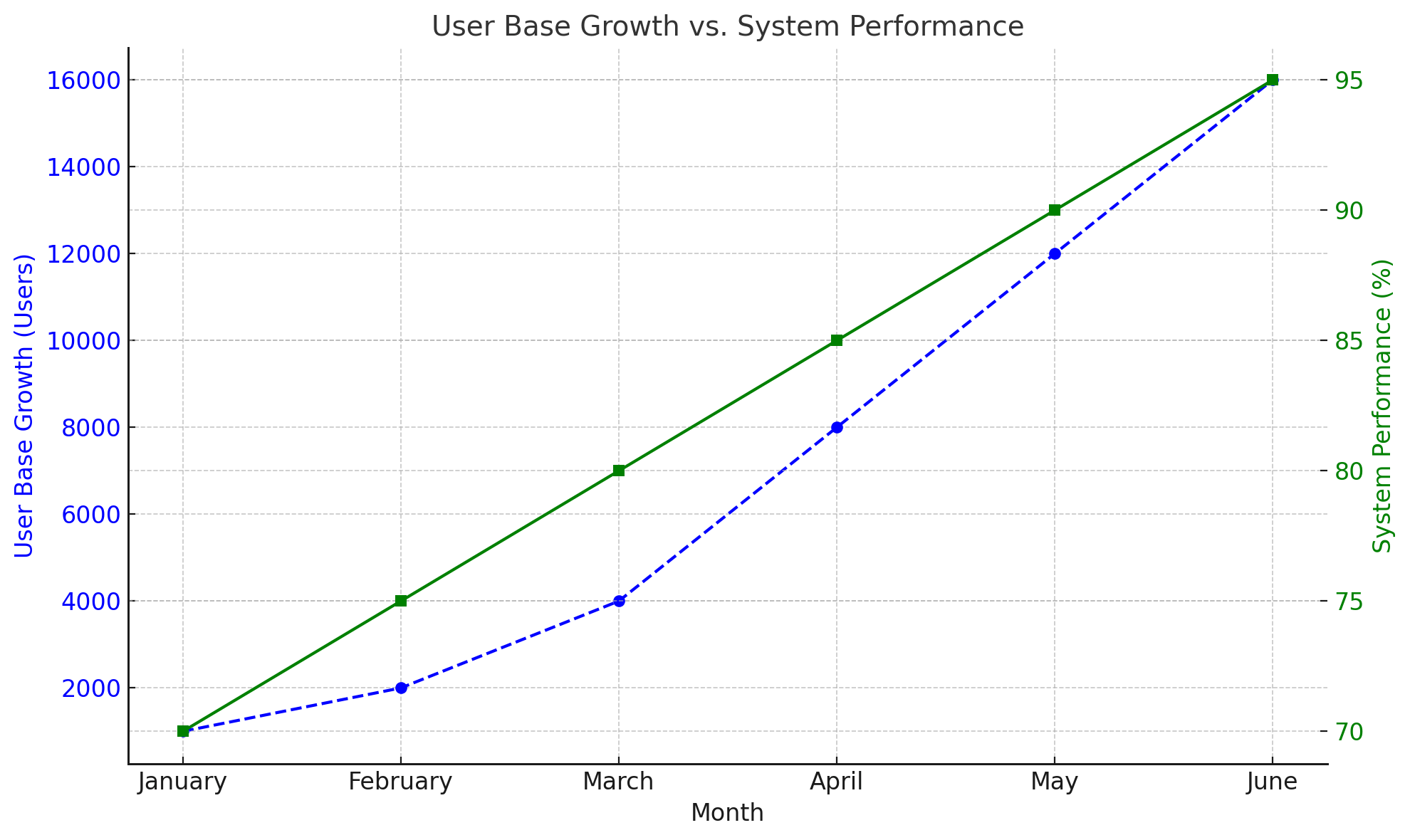

2. Enhanced Scalability

- System handled a 10x increase in users seamlessly

- Auto-scaling capabilities ensured consistent performance during peak loads.

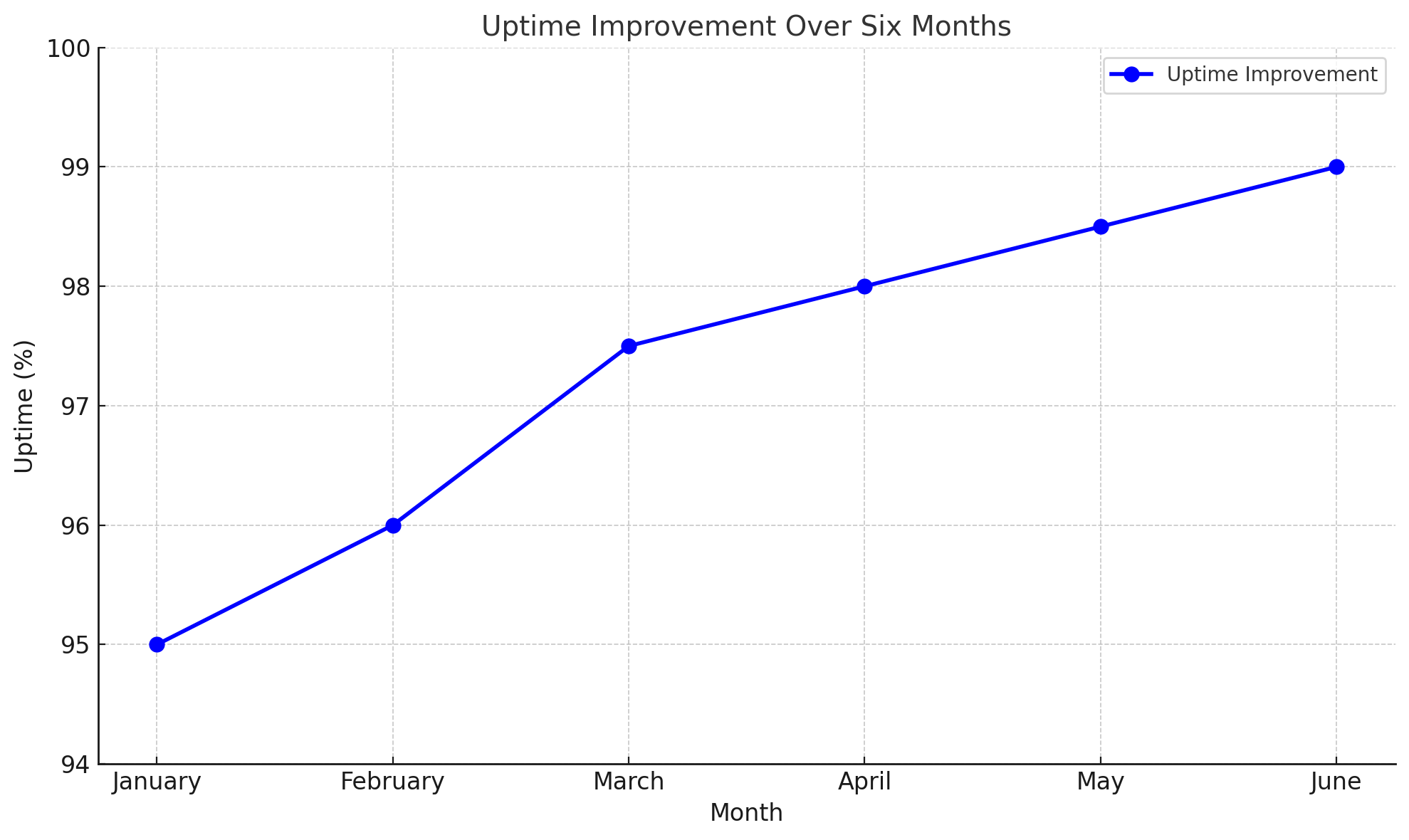

3. Increased Reliability

- Achieved 99.995% uptime.

- Downtime incidents reduced to near zero.

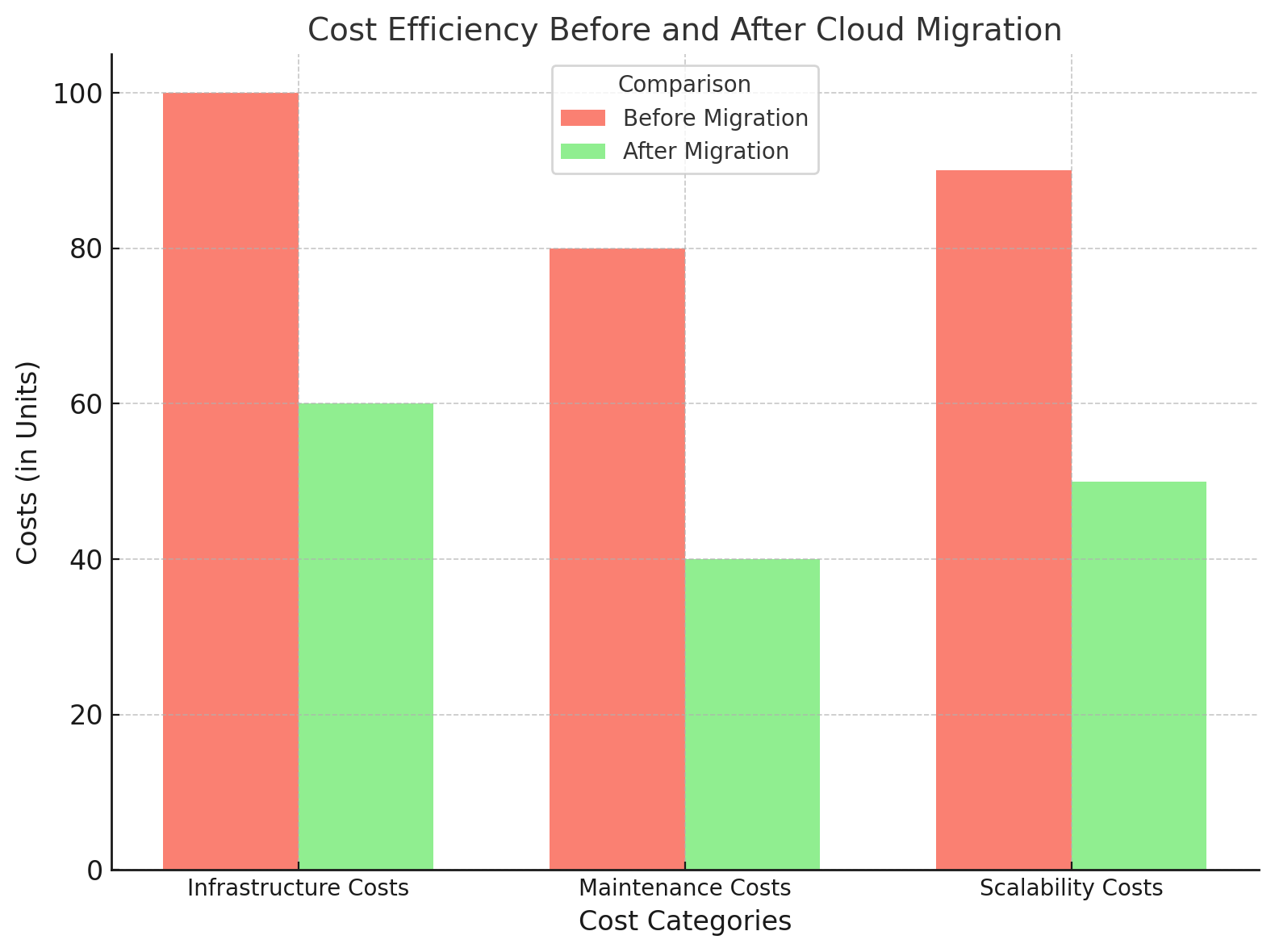

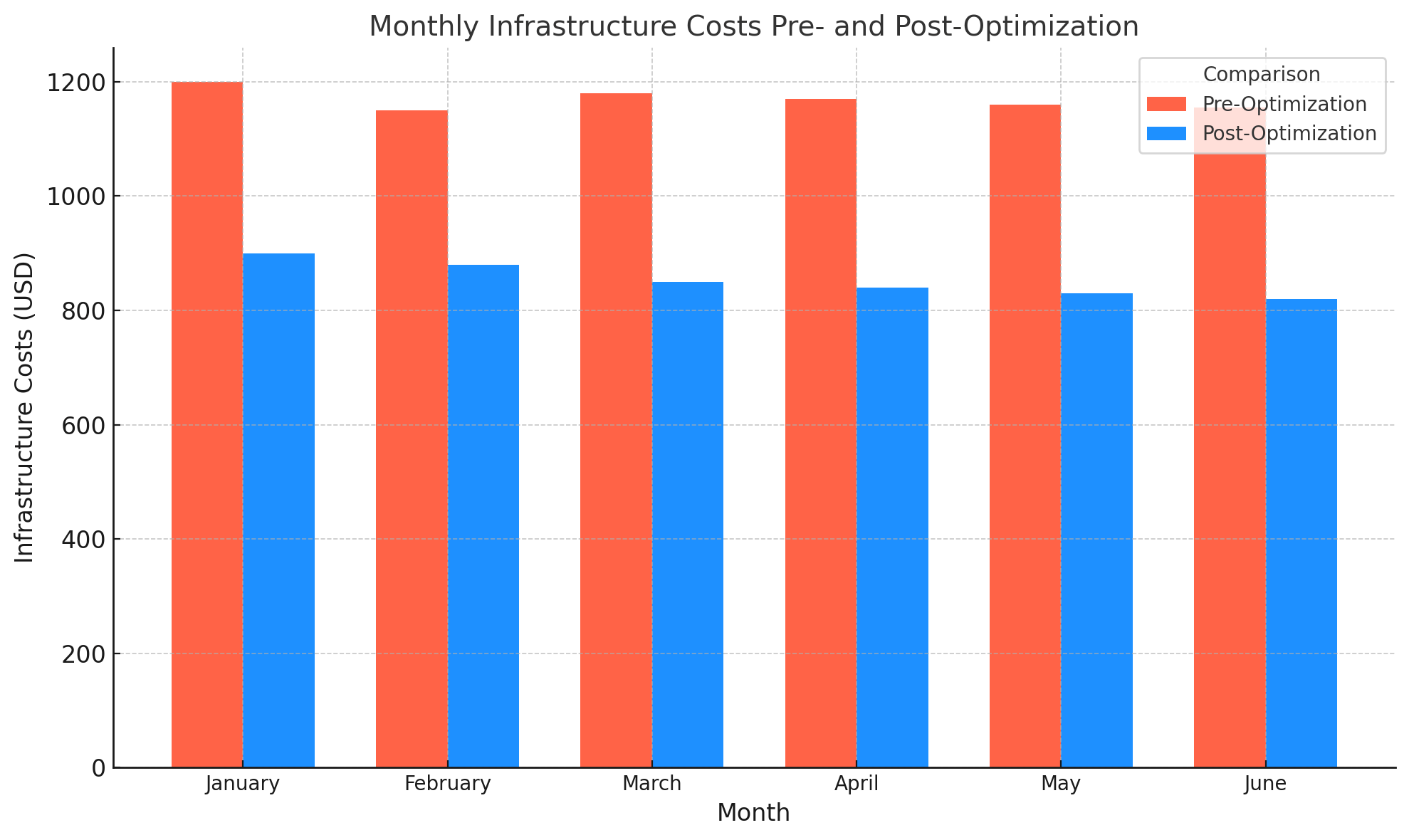

4. Cost Savings

- Infrastructure costs were reduced by 40%.

- Optimized resource utilization eliminated over-provisioning.

Lessons Learned

1. Plan for Future Growth

Building with scalability in mind prevents the need for frequent overhauls.

2. Invest in Automation

Automated processes reduce errors and speed up deployment cycles.

3. Prioritize Security

Scaling should not compromise the security of sensitive data.

4. Monitor and Iterate

Regular performance monitoring ensures the system evolves with user demands

Conclusion

Scaling a fintech application infrastructure for 10x growth is no small feat. Through strategic planning, cutting-edge technologies, and continuous optimization, we helped this fintech startup achieve unparalleled performance and reliability.

As fintech continues to evolve, scalable and secure infrastructure will remain a cornerstone of success. If your organization faces similar challenges, let’s explore how we can help you build for the future.

FAQs

The startup faced issues such as limited server capacity, slow response times during peak traffic, difficulties in handling concurrent users, and a lack of automated systems for scaling resources. These challenges risked affecting user experience and operational efficiency as the business grew.

The scaling process involved:

- Migrating to a cloud-based infrastructure for flexibility and scalability.

- Implementing containerization (e.g., using Docker and Kubernetes) to streamline deployments and resource management.

- Setting up auto-scaling mechanisms to handle traffic spikes efficiently.

- Optimizing the database architecture to ensure faster queries and high availability.

Key technologies included:

- Cloud platforms: AWS, Azure, or Google Cloud for scalable resources.

- Containerization: Docker and Kubernetes for efficient application deployment and management.

- Load Balancers: To distribute traffic evenly and ensure system stability.

- Monitoring Tools: Tools like Prometheus, Grafana, and New Relic to track performance and troubleshoot issues.

After scaling, the fintech startup achieved a 10x increase in user capacity, significantly improved application performance, reduced downtime, and maintained a seamless user experience even during high traffic periods. The infrastructure's flexibility also allowed for easier deployment of new features and faster response to market demands.